The RBA is expected to lower the cash rate amid escalating global trade tensions

The RBA is expected to lower the cash rate amid escalating global trade

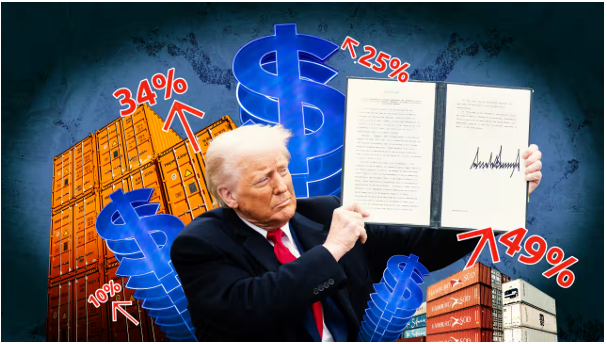

tensions. In the context of a world grappling with significant upheavals from U.S. tariff policies under President Donald Trump, the Reserve Bank of Australia (RBA) is facing immense pressure in managing its monetary policy, with many forecasts suggesting that a substantial interest rate cut could occur as early as next May.

External risks are escalating:

The United States' imposition of unprecedentedly high tariffs—125% on Chinese goods (as updated on April 10), 24% on Japanese goods, and 10% on imports from Australia—has sparked deep concerns about the ripple effects on global supply chains and economic growth. Although Australian goods face the lowest tariff rate, the indirect impact through major trading partners like China and Japan cannot be underestimated, as these two countries account for up to 50% of Australia’s total export volume.

Pressure on the domestic economy and the RBA:

In response to these global risks, markets and major financial institutions have swiftly adjusted their expectations for the RBA’s monetary policy:

● Deutsche Bank forecasts a 50-basis-point rate cut in May—double the usual

magnitude—to counter the shock from the global trade war.

● Commonwealth Bank and NAB also project a total of three rate cuts in 2025,

lowering the interest rate from 4.1% to approximately 3.35% by year-end.

Phil O’Donaghoe, Chief Economist at Deutsche Bank, argues: “The RBA needs to act more decisively. This isn’t just a response to inflation—it’s about safeguarding economic growth and market confidence amid global uncertainty.”

Lower interest rates: Opportunities and risks

A significant rate cut as forecasted would bring direct benefits to the public, particularly households with mortgages. For a $500,000 AUD home loan, a 50-basis-point reduction could lower monthly repayments by approximately $152 AUD.

However, experts also warn that an overly aggressive cut could send a negative signal to the market, fostering panic and undermining consumer confidence. Gerry Harvey, one of Australia’s prominent business figures, cautions that a sudden rate cut might be perceived as an “emergency measure,” fueling fears of a recession.

The response of the RBA and the government:

In its most recent meeting, the RBA maintained the interest rate at 4.1% and reiterated its “data-dependent” stance. However, with consumer sentiment plummeting and external risks becoming increasingly evident, the pressure on the RBA is intensifying. The federal government has also introduced a $1.05 billion AUD support package to assist businesses in redirecting exports and adapting to global trade shifts, underscoring the gravity of the situation.

The RBA is entering an exceptionally delicate phase of policy management. On one hand, itmust bolster economic growth in the face of external threats; on the other, it needs to avoid triggering panic or losing control of inflation. Forecasts of a substantial interest rate cut are well-founded—and next May could prove to be a pivotal moment for Australia’s monetary policy in 2025.

Reference Source: (Quang Tuấn Nguyễn 9/4/2025 - nguồn tin tổng hợp)